Global equity markets climbed higher during the month of October, as positive corporate earnings releases and better than expected macro data led to robust returns from US and European equity markets.

Emerging market equities lagged the performance of developed market equities over the month, as concerns around higher inflation and the possibility of a more aggressive interest rate hiking cycle in key emerging markets dampened risk appetite.

In the US, a $1 trillion infrastructure bill managed to pass a Senate vote, however, it has yet to pass a vote from the House of Representatives. US President Joe Biden’s scaled back social spending bill is yet to be agreed on, with the latest package amounting to $1.75 trillion.

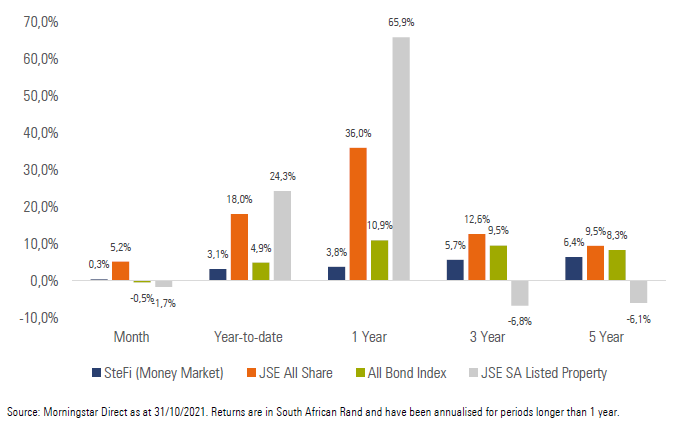

Exhibit 1: SA Market Performance (total returns)

South African equities delivered strong returns in the month of October, largely driven by robust performance from the Resources sector, as well as large Industrial index constituents.

Local bonds had another tough month, as the potential of an earlier interest rate hiking cycle by major central banks pushed bond yields higher, which impacted the performance of short and medium dated exposures in particular.

Local listed property gave up some gains during the month, weighed down by poor performance from some large index constituents, despite decent performance from some offshore focused counters.

The rand was weaker against most of the major developed market currencies over the month, despite significant volatility during the month which led to the rand trading in quite a wide range against the US dollar during October.

South Africa’s trade surplus for September declined to R22 billion, compared to an average of R50 billion per month from April to August as exports decreased 1% month on month and imports rose 16% month on month.

SA headline CPI accelerated to 5.0% year-on-year for September (from 4.9% in August), despite a moderation in food prices. The increase in inflation was largely driven by an increase in the petrol price, which had a large impact on public transport prices, as well as higher housing and utilities inflation.

In terms of Covid-19 infections, South Africa continued to show a decline in daily infections, with data showing that 22.4 million vaccines had been administered by 31 October 2021.

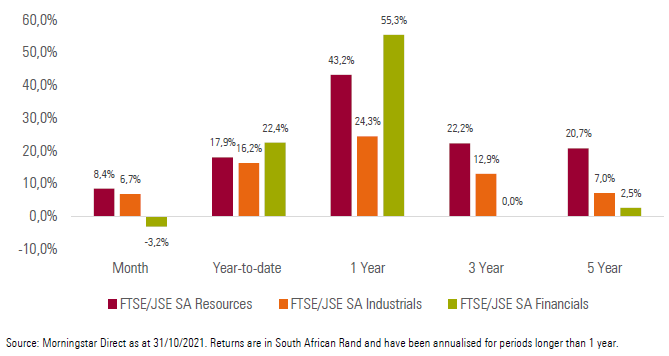

Local equity sectors had mixed performance for the month, with Resources (+8.4%) and Industrials (+6.7%) ending the month higher, while Financials (-3.2%) ended the month with disappointing performance.

Exhibit 2: SA Sector Performance (total returns)

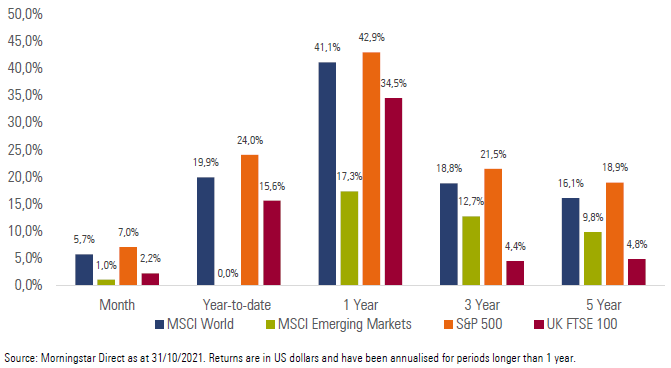

Most of the major developed equity markets ended the month higher, driven largely by positive earnings announcements and robust economic growth. The MSCI World Index delivered a return of +5.7% for the month.

Emerging market equities (EM’s) managed to deliver positive performance, however, the asset class delivered weaker performance compared to developed markets, largely due to concerns around materially higher inflation and the possibility of an aggressive interest rate hiking cycle in some EM’s. The MSCI Emerging Markets Index delivered a return of +1.0% for the month.

Most of the major equity markets ended the month with decent performance. The UK’s FTSE 100 (+3.9%), Germany’s FSE DAX (+2.7%) and China’s Shanghai SE Composite (+0.4%) all ended the month higher. Japan’s Nikkei 225 (-4.0%) bucked the global trend slightly, ending the month lower.

US equities delivered strong performance, with both the technology heavy NASDAQ 100 (+7.9%) and the S&P 500 (+7.0%) ending the month higher.

Exhibit 3: International Market Performance (total returns)

Impact on client portfolios

Most portfolios generated decent returns over the month. This was largely driven by strong performance from local and global equities. The weaker rand over the month acted as a slight tailwind to the performance of offshore allocations. Those portfolios with an income focus struggled to generate meaningful performance over the month, largely due to disappointing performance from the local bond market. The bond market came under pressure as yields moved higher (moving prices lower) in response to concerns around inflation and a steeper interest rate hiking cycle.

We remain comfortable with the current positioning of client portfolios, both from an asset allocation and a manager selection perspective. We will continue to follow our valuation driven approach by allocating assets to the most attractive areas of the market from a reward for risk perspective. We are confident that we will continue to deliver on the specific investment objectives of each client portfolio independent of the prevailing market environment.

Market summary

Click on the link below to download October’s market summary.