Most major global equity markets ended the month with either modest gains or in negative territory, as concerns around the rapid spread of the Covid-19 Delta variant spooked investors. That said, the vaccination drive in developed markets across Europe (particularly in the UK) and the US continued, with between 50-60% of the population in these regions at least partially vaccinated.

The US Federal Reserve (Fed) met during the month and kept interest rates unchanged, however, its 2021 calendar year inflation forecast moved slightly higher. What surprised some market participants was the slightly more hawkish tone from the Fed, as they signalled that there could be two interest rate hikes in 2023, with the first hike expected in Q3 2023 (slightly earlier than the original early 2024 estimate).

The Fed’s preferred measure of inflation, core personal consumption expenditure (PCE) moved higher to a year-on-year figure of 3.4% in May (the highest increase in prices since 1992) from 3.1% in April. The Fed has continued with its rhetoric that these price pressures are driven by supply bottlenecks and the reopening of the economy and are, therefore, transitory.

Exhibit 1: SA Market Performance (total returns)

South African equities ended the month lower for the first time in eight months (since October 2020), as disappointing performance from resource counters (gold counters in particular) weighed on the performance of the local equity index.

Local bonds ended the month higher, despite foreign selling (foreigners sold R14.2 billion of SA bonds in June) and a weaker rand acting as a headwind to the performance of the asset class.

Local listed property delivered strong performance for the month, despite giving up some gains towards the end of June on the back of concerns around further Covid related restrictions.

The rand reversed some of its recent impressive run, ending the month weaker against most major currencies as hawkish comments from the Fed proved supportive of the performance of the US dollar.

South African President Cyril Ramaphosa announced that the country will move to an amended level 4 lockdown (effective from the 28th of June) which includes restrictions on alcohol sales, prohibiting indoor and outdoor gatherings and an extension of the overnight curfew. The harder lockdown measures come on the back of a surge in Covid-19 infections across the country as a result of the highly contagious Delta variant.

SA headline CPI moved significantly higher to a year-on-year figure of 5.2% for May (from 4.4% in April), as the base effects of higher fuel and food prices filtered through to the inflation print.

SA’s trade balance came in at a surplus for May (R55 billion), following a revised surplus for April of R51 billion, as exports increased 1.5% month on month and imports retreated slightly.

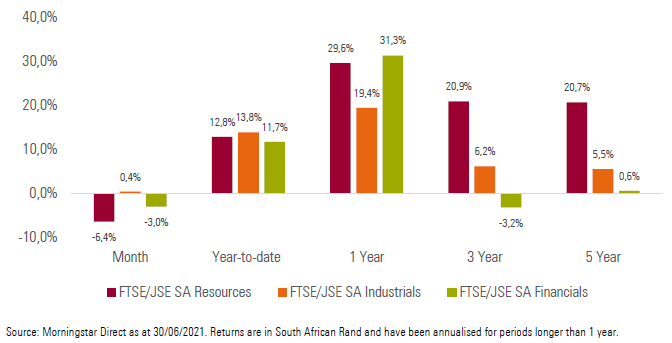

Local equity sectors had mixed performance for the month, with Industrials (+0.4%) outperforming both Financials (-3.0%) and Resources (-6.4%).

Exhibit 2: SA Sector Performance (total returns)

Most major developed equity markets struggled to generate positive returns for the month, as concerns around the spread of the Delta Covid-19 variant weighed on sentiment. The MSCI World Index still managed to eke out a positive return, delivering performance of +1.5% for the month.

Emerging market equities underperformed developed market equities slightly over the month, despite managing to deliver positive performance. The MSCI Emerging Markets Index delivered a return of +0.2% for the month.

Most major equity markets ended the month lower, with Japan’s Nikkei 225 (-1.5%), China’s Shanghai SE Composite (-2.2%), Germany’s FSE DAX (-2.3%) and the UK’s FTSE 100 (-2.4%) all ending the month in the red.

US equities bucked the global trend, ending the month higher, largely on the back of strong performance from technology counters. The technology heavy NASDAQ 100 (+6.4%) was the standout, however, the S&P 500 (+2.3%) also delivered decent performance.

Exhibit 3: International Market Performance (total returns)

Impact on client portfolios

Portfolios delivered mixed performance for the month. Those portfolios with significant allocations to global equities delivered decent performance, assisted by the weakening rand over the month, while those with significant allocations to local equities delivered more muted returns. Income focused investors managed to generate positive performance for the month, as the local bond market managed to deliver decent returns despite the weak rand and foreign selling of SA bonds during the month.

We remain comfortable with the current positioning of client portfolios, both from an asset allocation and a manager selection perspective. We will continue to follow our valuation driven approach by allocating assets to the most attractive areas of the market from a reward for risk perspective. We are confident that we will continue to deliver on the specific investment objectives of each client portfolio independent of the prevailing market environment.

Market summary

Click on the link below to download June’s market summary.