Who would have thought we would kick off 2021 in almost the same manner as 2020? Even though we were all hopeful that 2021 would start on better footing, numerous countries are still in lockdown, South Africa is fighting against its second surge of Covid- 19 infections and economies worldwide continue to struggle. For humanity, we gladly waved goodbye to 2020, but for markets, we have seen a period of surprising benefit and near-record highs.

Global and local equities, bonds, gold, commodities, and even bitcoin have all moved forward and delivered positive performance despite struggling economies, widespread job losses and the biggest contraction in almost 90 years.

The final quarter of 2020 was strong by historical standards. Investor sentiment had been lifted by the news of the rollout of a vaccine worldwide alongside the perception of greater political stability.

In an article I wrote at the end of 2020, I used the analogy of a rollercoaster ride to describe the year – not only from a market perspective but especially from an emotional perspective. 2020 marked one of the most severe sell-offs in market history with three of the worst trading days recorded (historically) in March alone. With that being said, we also experienced the shortest bear market recorded (spanning over just 33 days) with most markets now sitting at all-time highs.

The one thing that 2020 highlighted again was our behavioural biases, exposing our good and bad traits when it comes to investing.

Let’s look at some of the lessons learnt in 2020 that will be worth remembering in 2021 and beyond.

1. Markets cannot be timed

Let’s say, hypothetically, you had anticipated that there was going to be a global pandemic, which you know would scare investors across the globe, resulting in sharp declines in the global stock markets, and you decided to withdraw your investment(s). Even with this knowledge, it would have been extremely difficult to predict the timing and strength of the rebound in the market. In this case, the severe downturn has (in many instances) corrected itself within a mere six months. Ultimately, you may very well still be sitting on the sidelines waiting for a better entry point to get back in.

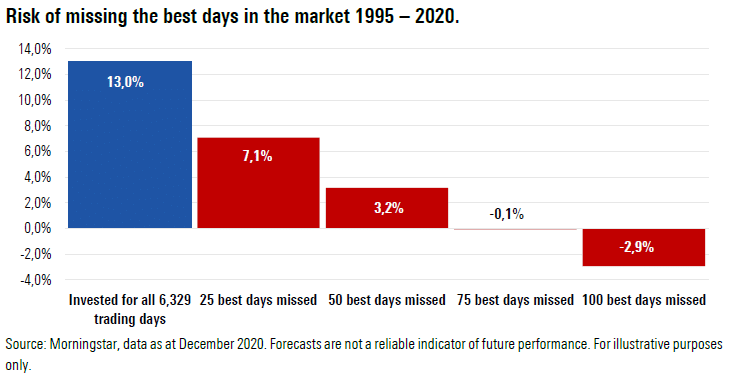

It is critically important to remain invested, through good and bad times. Often the worst days in the market are followed by the best days. Unfortunately, you need to be invested through both the good and the bad to reap the benefits of gaining long-term market returns, which translate into wealth creation over time.

The graph below illustrates how missing a couple of good days in the market can severely impact your portfolio return over time.

2. Good follows bad, and vice versa

Although we have no way of knowing when a market crisis will start, we can be sure that it will end. Historically, a sharp market decline is generally followed by a strong rally. The timing of when that advance occurs is the only unknown variable at play.

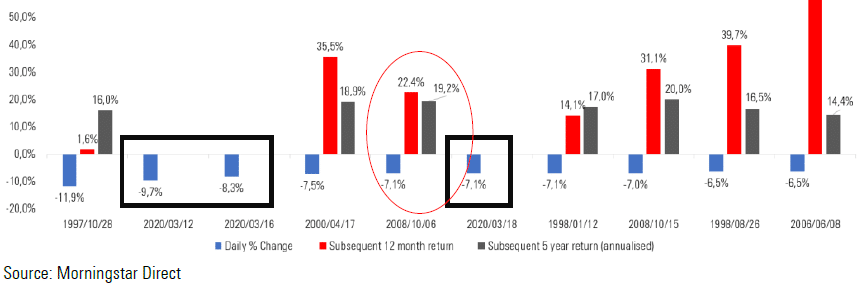

South African equities experienced four of the largest one-day losses over a couple of weeks in March. In the below graph –

- The blue bars, show the 10 worst days on the JSE since the end of June 1995 and how the local market reacted after the

- The red bars show the 12-month returns investors experienced after the worst

- The grey bars show the five-year annualised returns after the drawdown

As an example, during the 2008 global financial crisis on 06/10/2008, there was a loss of -7.12% for the day but the subsequent one-year return amounted to 22.41%, with an annualised (average return per year) five-year return of 19.24% per year.

Yet another reason to remain invested throughout a crisis.

3. Optimism remains the only realism

Humans have overcome incredible challenges throughout the centuries, and we are on our way to overcoming the latest challenge. Little did we realise just how much we would discover, explore, learn, and experience in a year that has brought with it so many different challenges and, in some cases, opportunities.

Let us not forget the lessons we learnt in 2020 as we face the new year that will bring with it, its own challenges and uncertainties.

Looking to the future

It is incredibly important that investors must consider the risks they can’t see or at least those they haven’t given weight to. Above all else, investors need to carefully consider the valuations they are paying, as we have seen extreme divergences that presents both an opportunity and a risk.

As Warren Buffett once said, “Only when the tide goes out do you discover who has been swimming naked”. We remain confident that our positions are in the best interests of our clients—acknowledging tomorrow’s challenges and working towards a prosperous 2021 with good financial decision making.